Application Description

Take control of your financial health today by downloading the CreditScore, CreditCard, Loans App! This powerful tool provides you with a comprehensive free credit report from multiple credit bureaus, including CIBIL, and keeps you updated with your latest credit scores. Tailored to meet your unique financial needs, the app offers personalized loan and credit card offers from India's leading banks and financial institutions. Whether you're in the market for a new credit card, a personal loan, or even a home loan, the app presents a diverse array of options to help you find the perfect fit. With expert assistance, instant micro-loans, and pre-approved offers, managing your finances has never been more streamlined. Join the ranks of over 22 million satisfied consumers and embark on your journey towards financial freedom with the app today.

Features of CreditScore, CreditCard, Loans:

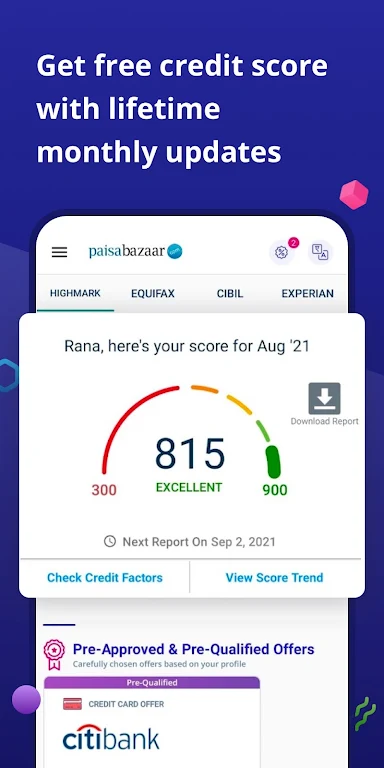

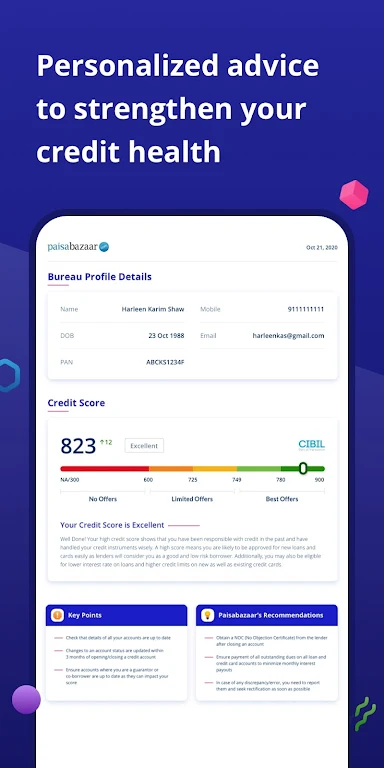

Free Credit Report: Access your credit report from multiple credit bureaus, including CIBIL, at no cost, ensuring you stay informed about your credit status.

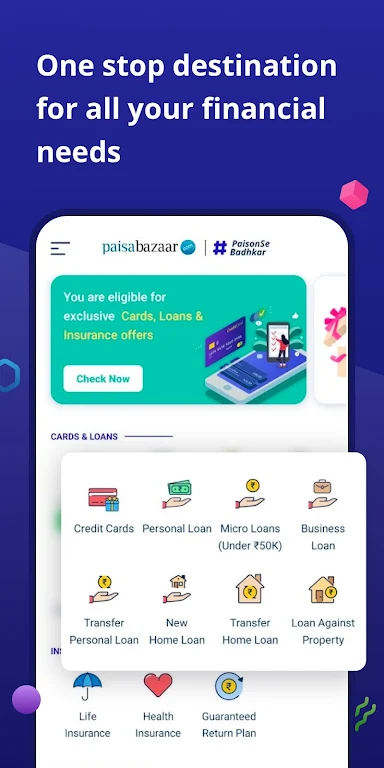

Wide Range of Products: Select from over 60 partners providing more than 35 different credit cards and instant micro-loans, giving you a broad spectrum of choices.

Personalized Offers: Receive pre-approved loan and credit card offers tailored specifically to your needs, with the convenience of instant disbursals.

Easy Comparison: Effortlessly compare, select, and apply for the most suitable loan or credit card with digital tools and expert guidance at your fingertips.

Business and Home Loan Options: Delve into various business loan offers and secure home loans with competitive interest rates, designed to support your major financial decisions.

Secure Platform: Safeguard your financial information by tracking all your debit and credit balances in one secure and convenient location.

FAQs:

What is the repayment tenure for Personal Loans?

- Personal Loans typically offer a repayment tenure that spans from 3 months to 5 years, allowing you flexibility in managing your debt.

How is the APR calculated for a Personal Loan?

- The APR for a personal loan can range from as low as 9.9% to as high as 35%, influenced by your personal credit profile and the specific policies of the lender.

What are the total costs involved in taking out a personal loan?

- The total cost of a personal loan encompasses the principal amount, interest charges, loan processing fees, documentation charges, and any amortization schedule charges, ensuring you have a clear picture of your financial commitment.

Conclusion:

With an extensive range of financial products, user-friendly comparison tools, and robust security features, CreditScore, CreditCard, Loans serves as your ultimate financial companion. Empower yourself to make informed decisions and access the best loan and credit card offers from India's top banks and financial institutions through a seamless digital experience. Make the wise choice for your financial future by choosing the app.

Other

Application Description

Application Description  Apps like CreditScore, CreditCard, Loans

Apps like CreditScore, CreditCard, Loans